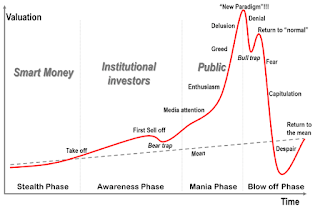

In spite of the recent volatility and lack of direction in the Gold futures market, I decided that it is time to dedicate a special blog post to it, try to make sense of it all through the perspective of a classical technical analysis chart pattern.

While observing the price action in the last 2 months (see the chart attached), a few things become clear - the market looks quite chaotic and random at first sight - it is volatile, unpredictable, the zones of support/resistance do not act as such, the market makes lower lows and higher highs, both bulls and bears seem unconvinced about direction, volatility is expanding. If I was just entering into trading, I'd say - "Screw this, this is a manipulated bullshit market, there's no way anyone could trade this, it just doesn't make any sense!"

Well, maybe I would have said that 5 years ago and I would have been right about it, but having already collected some experience in this business, it's been long enough to know that after every period of randomness and indecision, a new pattern starts to take shape sooner or later. "Order arises out of chaos" - every theoretical physicist who knows the ways and the patterns of the Universe will tell you this, I can assure you markets are no different! There is randomness to some extent but if you observe it on a long enough time frame or if you just zoom out, you'll see well-structured patterns starting to take shape.

Now to the point. Being a left-handed, my brain uses "visual simultaneous" method to process information, as opposed to "linear sequential" of the right-handed people, i.e. it is a natural pattern-matching machine (read more about it

here). Simply said, my brain automatically compares multiple visuals simultaneously without the least effort, I can almost see them in front of my eyes like holograms, that's the power of the active imagination.

Anyway, I was quickly scanning through the charts yesterday while drinking my morning coffee and doing some other stuff on the computer, thinking about who to drag with me to the river beach in this hot Saturday, when it suddenly hit me! Damn, I've seen this pattern before! I even remember its name - "MegaPhone" or "Broadening Top"! It is a very rare but extremely reliable pattern identifiable by series of higher highs and lower lows with expanding volatility.

Here is a more detailed description:

A Megaphone Top, also known as a

Broadening Top, is considered a bearish signal, indicating that the

current uptrend may reverse to form a new downtrend.

A Megaphone Top is formed because the stock makes a

series of higher highs and lower lows. The Megaphone Top usually

consists of three ascending peaks and two descending troughs. The signal

that the pattern is complete occurs when prices fall below the lower

low.

The creation of the pattern reflects a period of

time when bulls and bears are battling to gain control of the stock. The

pattern occurs after the bulls have been charging and driving the stock

price appreciably higher. During the formation of the Megaphone Top,

however, bears are exerting increasing influence on the stock and

causing it to set a series of lower lows. The increasing volatility

eventually creates a sense of uncertainty, leads to profit-taking, and

deters some of the bulls from making any further commitments.

The bears eventually triumph.